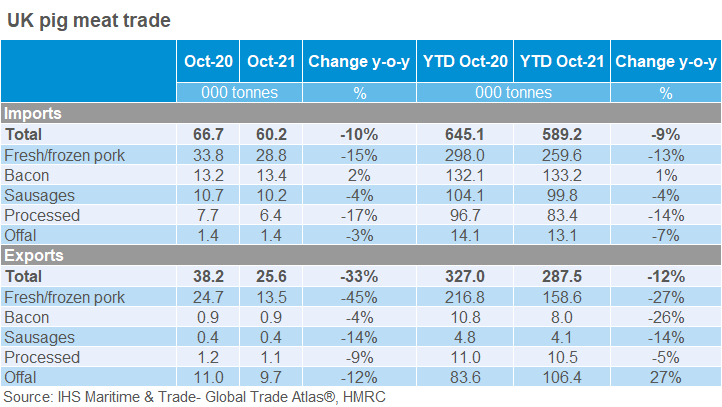

The UK’s export performance remained subdued in October, with fresh/frozen pork shipments down compared to both September (-5%) and October the previous year (-45%), at 13,500 tonnes.

The continued weakness in the Chinese market has been a key factor in the drop off, with UK pork shipments to China barely over 4,000 tonnes, just a third of last year’s level, and the lowest volume since December 2018. Exports to the EU were also down 35% to under 7,000 tonnes.

AHDB lead analyst Bethan Wilkins commented: “Falling Chinese demand has led to oversupply within the EU and low prices, meaning UK product is uncompetitive. Ongoing effects of Brexit are also probably still playing a role.”

Shipments of bacon, ham and sausages also recorded declines, as did offal exports. Ham imports were also 17% lower than in 2020 and sausage volumes were 4% lower, continuing trends seen throughout the year so far.

However, despite pork imports overall being lower, volumes of boneless product held steady, as processors attempted to dedicate their own butchery staff to dealing with British pigs.

Ms Wilkins added: “Low prices for pork in the EU are likely still having a negative effect on our domestic pork prices, as long as the potential remains for this pork to be imported if its price competitiveness is strong. Nonetheless, so far it seems that the volume of EU pork that has actually arrived in the UK is relatively low.”