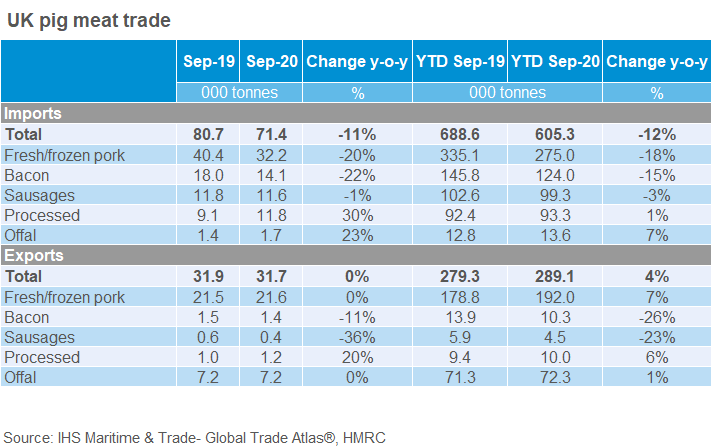

UK pig meat exports continued a stable performance in September, with volumes holding steady on 2019 levels, which were 5% above 2018, according to AHDB analyst Bethan Wilkins.

The sustained demand is partly due to a continued strong demand from China, likely as a result of Germany losing access to China following an outbreak of African Swine Fever mid-September. China remains by far the leading destination with 43% of fresh/frozen pork exports were shipped there.

However, exports to a number of other important markets dropped back compared to last year. The Netherlands received significantly less pork, with September shipments about half of 2019 levels. Ireland was also sent 20% less UK pork than last September.

Fresh/frozen pork volumes totalled 21,600 tonnes, slightly higher than both the previous month and September last year.

Offal exports also remained similar to year earlier levels, with increasing demand from a number of destinations, including China and a number of EU markets.

On imports, Ms Wilkins said: “Most suppliers decreased shipments to the UK, the exceptions being Denmark, Portugal and Austria. Denmark remains by far the principal source. Imports of cured pig meat also fell sharply. Sausage imports continued to be less affected by the general declining trend.

“Conversely, imports of processed pig meat increased on the back of more shipments from Poland and Ireland in particular. This was only partially offset by decreased trade with the Netherlands.”

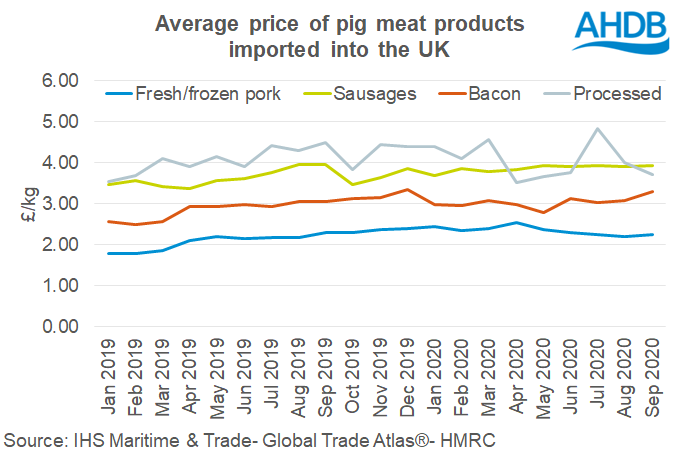

The average price of imported fresh/frozen pork has declined in recent months, but the picture is more varied for other products, likely due to the varying mic of imported products.