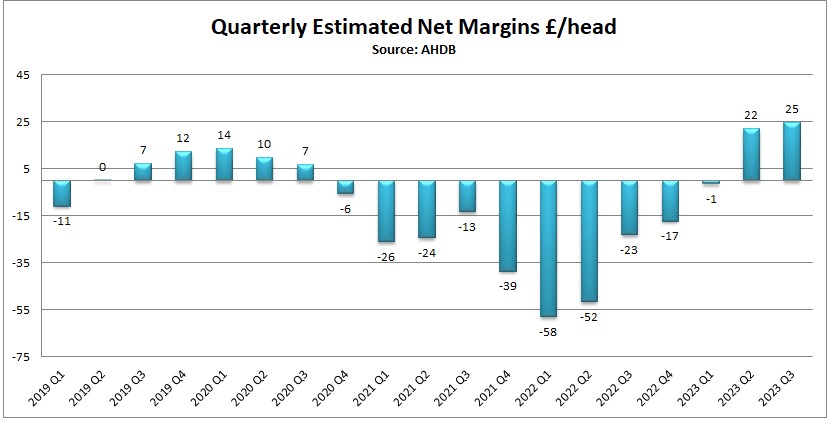

UK pig producers, on average, made a profit of £25 per finished pig during the third quarter of this year, as the industry continued to recoup some of the huge losses made over the past two years.

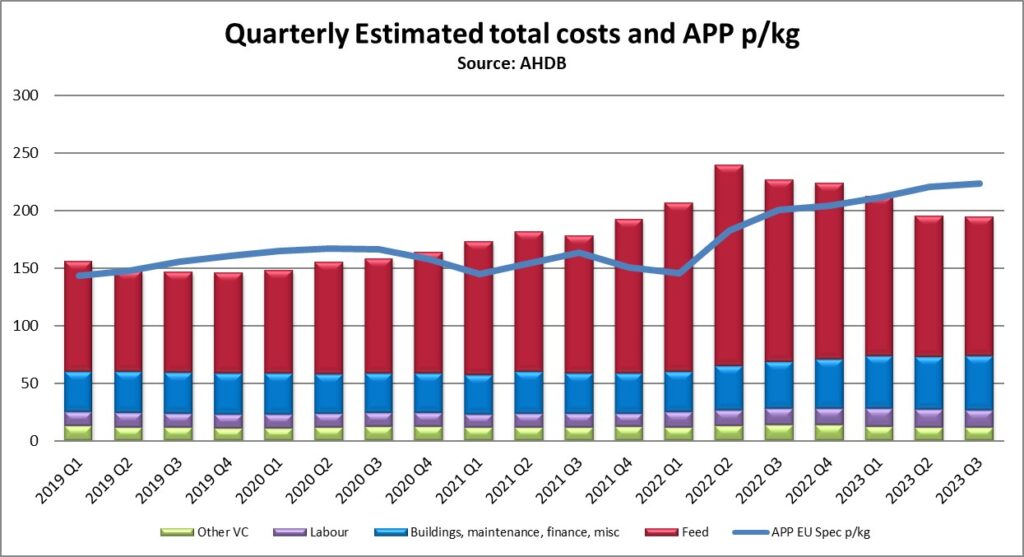

AHDB net margin data estimates that the full economic cost of production for Q3 was 195p/kg deadweight, 1p below the figure for Q2.

Feed costs fell slightly again to make up an estimated 62% of total costs over the quarter, compared with 70% in Q3 2022, when feed costs were at record highs. Energy costs have also been coming down, which has contributed to falling costs, compared with the high prices through 2022 and the first half of 2023. More recently, however, fuel costs have risen slightly, which has limited the fall in production costs.

Pig prices have been at historic highs during Q3, increasing by 3p on Q2 to average 224p/kg (APP) over the three-month period.

This equates to a net margin of 29p/kg, or £25 per slaughter pig, slightly up on the Q2 margin of £22/head and the highest quarterly figure for some time.

However, this follows 10 successive quarters of negative margins, including average quarterly losses well in excess of £50/head in the first half of 2022. It is estimated that the pig industry lost more than £750m over a two-year period of negative margins, during which the sow herd contracted dramatically.

Unsurprisingly, there has been a cautious approach to herd rebuilding and investment, given the scale of the industry’s financial black hole.

Future prospects

Pig prices started to fall in August – the SPP fell from 225.65p in mid-August to below 219p in late-October, with the APP dropping by a similar margin – and this will influence margins in the current quarter.

Feed ingredients, led by wheat, have remained relatively stable through the autumn, however.

AHDB’s estimates use performance figures for breeding and finishing herds. Due to changes in provider, the figures for Q3 2023 feeding and breeding herds use 12-month performance data from March 31, 2023.