Volumes of UK imports and exports were both well down in January, the latest trade figures from HMRC show.

Total pig meat imports for the UK in January were 3.4%, 2,100 tonnes down on December 2022 at just under 60,000t. More strikingly, January import volumes were down a massive 24.1%, 19,100t, on January 2022. This fall comes at a time of falling UK supplies of pigmeat, but also at a time of rising EU prices.

Shipments from the Netherlands and Germany have seen substantial falls, down 51% (11,600t) and 44% (8,100t) from January 2022 levels, likely a result of lower production and therefore reduced supplies available. There has been growth in imports from Denmark, up 1,100t (8%), Ireland up 880t (19%), and Belgium, up 620t (32%).

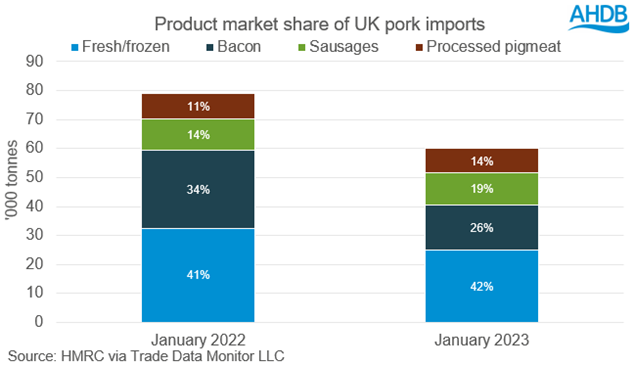

Import volumes for all product categories fell between December and January, with the exception of fresh/frozen pork which recorded a marginal increase, up 1.6% (403t). However, year on year imported volumes of fresh/frozen pork fell by 23.4% (7,600t). Sausages was the only product category to record year on year growth in imports, up 2.9% (310t).

Exports

Total pig meat exports (excluding offal) in January were down nearly 20%, 3,700t on December, and nearly 21% 3,900t year-on-year. Exports to China were down just under 30%, 1,900t, on the month, with similar percentage declines seen on exports to Ireland (-940t) and France (-530t).

Year-on-year growth looks to have been stronger for EU countries, with shipments having increased between 240-400t to France, Germany, and Ireland. Meanwhile, volumes shipped to China have fallen 2,700t (37%) on the year.

All product categories recorded declines in export volumes between December and January, according to AHDB analyst Isabel Shohet.

Volumes of fresh/frozen pork were down just over 3,000t on the month, with bacon, processed pigmeat, and sausages seeing smaller declines in volumes.

Year on year, all product categories except fresh/frozen pork have recorded volume growth in exports. The decline in fresh/frozen pork shipments (-4,600t) outweighed the growth in the other product categories.