The latest export data from the UK’s key pork suppliers suggests imports dropped significantly in the first quarter of 2018.

Estimates based on shipments from the UK’s seven largest suppliers of fresh/frozen pork, which account for around 95% of imports, suggest 112,000 tonnes cwe was shipped to the UK during quarter one. This is 12% less than the estimate for last year, likely following from the increase in domestic production recorded across the period. At 231,000 tonnes, UK production was 4% higher than year earlier levels in Q1.

Most of the key suppliers recorded lower shipments to the UK in Q1. Denmark and the Netherlands in particular recorded exports around 20% lower.

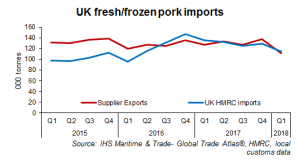

AHDB have been using partner country export data to estimate UK fresh/frozen pork import levels since mid-2016. This is due to concerns regarding the consistency of the HMRC figures, with the large increase in shipments reported around this time thought to be unlikely. However, as can be seen below, since around the middle of last year UK import figures seem to be aligning more closely with the overall trends recorded by our suppliers again. In Q1 this year, UK import figures indicates 114,000 tonnes of pork imports, 17% less than the previous year’s figure.

If these figures continue to align, it may be reasonable to assume that the reliability of our pork import data has improved. However, while the overall totals seem to be improving, when broken down on an individual country basis, discrepancies remain. UK imports of pork from Denmark were reportedly 30% lower than year earlier levels in Q1, a much larger decline than Danish export figure suggests. Conversely, our import figures suggest the decline from the Netherlands was smaller, at just 7%. As such, while overall trends may now be moving in the same direction, caution is still required when interpreting trade data.

Recently, the UK import figures for bacon have also caused concern. Imports have fallen significantly from the second half of 2018, according to HMRC data, with shipments from Denmark reportedly almost halving. While the UK has been importing less bacon, reflecting a move towards curing more product domestically, this decline seems exaggerated compared to export figures from our key suppliers, including the Danish export figures. This sentiment is backed up by anecdotal industry reports.

Based on the four largest UK bacon suppliers, which occupy around 95% of the market, 47,900 tonnes were shipped to the UK in Q1, 3% less than last year. In contrast, UK import figures suggest a decline closer to 20%, though the absolute number is higher at 56,100 tonnes. As such, while the reliability of fresh/frozen pork import figures may be improving, care still needs to be taken with the bacon figures for now.