UK pork imports rose in May as supplies of domestic pork remained suppressed due to the contraction of the national breeding herd.

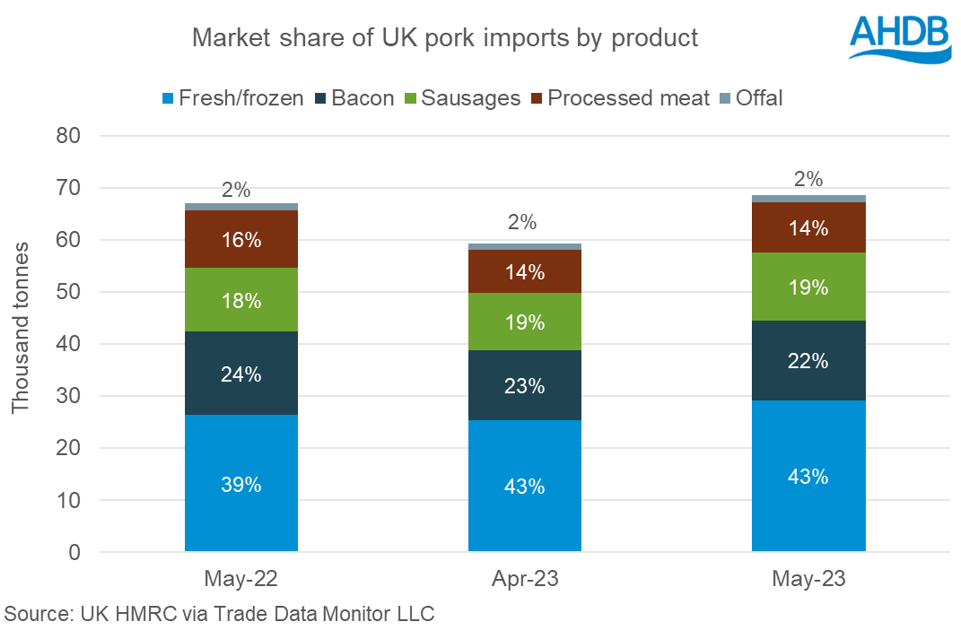

Total pork imports for the month, at 68,600 tonnes, were nearly 9,300 tonnes (16%) up from April’s levels and 2% (1,600 tonnes) higher than May 2022 levels.

Lower availability in the domestic market has been the driving factor behind increased in imports – UK pig slaughterings in May were 14% down on a year ago, following April’s 19% reduction, Defra figures show. The increase has been recorded despite tight EU supplies and high pork prices, with the gap between UK and EU prices remaining well below the normal difference.

The main source for UK imports in May was Denmark with 14,100 tonnes, an increase of 3,000 tonnes from April’s levels, AHDB senior analyst Soumya Behera said. This was followed by imports from Germany and the Netherlands at 13,300 tonnes and 12,200 tonnes respectively. The most significant changes on the year were noticed in imports from Denmark and Belgium which have seen shipped volumes grow by 1,800 tonnes and 1,600 tonnes respectively.

Fresh and frozen pork volumes continue to retain the majority market share in the import basket. In May, they stood at 29,200 tonnes, up 3,800 tonnes from April. Bacon imports stood at 15,300 tonnes while imports of sausages totalled 13,100 tonnes for the month, an increase of 1,900 tonnes and 2,000 tonnes respectively from the previous month. Processed pig meat imports increased by 1,500 tonnes month on month to stand at 9,600 tonnes in May.

Year on year, fresh and frozen pork volumes increased by 11% (2,800 tonnes). Sausages noticed an increase of 800 tonnes compared to May last year, while processed pig meat and bacon have declined by 1,400 tonnes and 700 tonnes respectively.

Exports

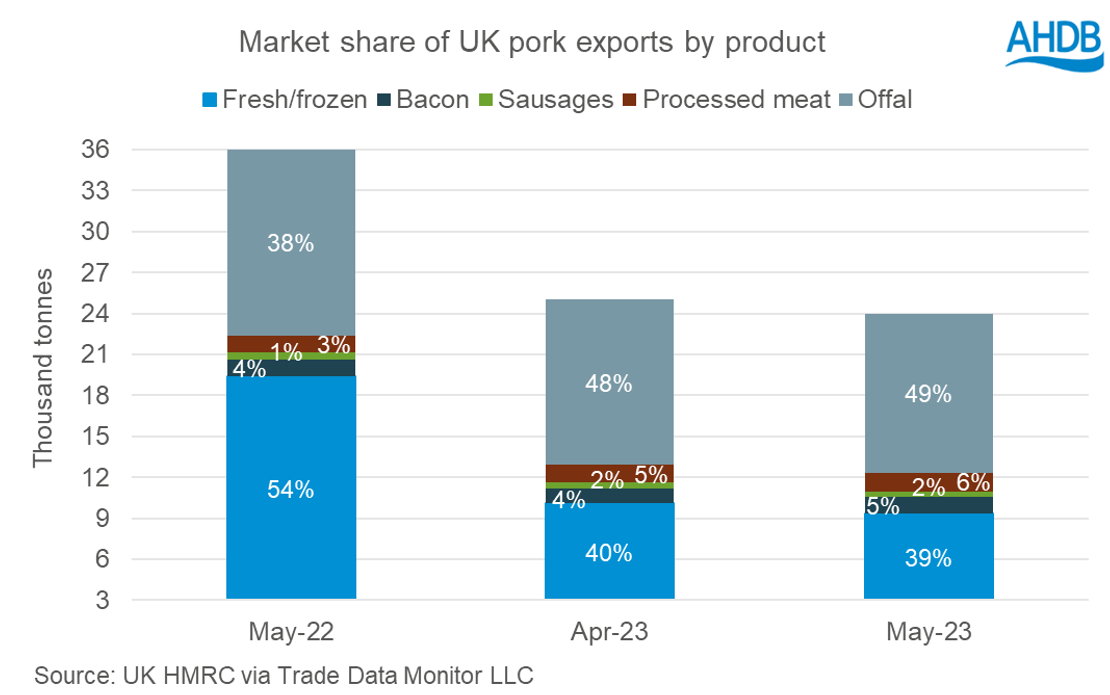

Pork exports remain well below year earlier levels – the total 24,000 tonnes for May was 1,000 tonnes (4%) down on April levels and a massive 33%, 12,000 tonnes, below the May 2022 figure. Lower availability in the domestic market has again been the driving factor behind the decline.

Exports to the EU were reported at 11,300 tonnes contributing to 47% of the export basket. The EU remains the key destination for fresh and frozen pork exports receiving 5,100 tonnes in May, a 54% market share.

Exports to China, at 8,100 tonnes in May, represented 34% of the total export volumes, although 5,500 tonnes of this volume was offal. Exports to China have declined by 2,000 tonnes from April and by 3,800 tonnes (32%) on the year. Shipments to the EU and the Philippines have increased marginally on the month, by 600 tonnes and 200 tonnes respectively, although they remain below volumes seen this time last year.

Fresh and frozen pork exports totalled 9,400 tonnes in May 2023, a decline of 700 tonnes from a month ago and of 52% (10,000 tonnes) year-on-year.

Processed pork exports increased on both the month and the year with volumes totalling 1,400 tonnes. Bacon exports increased compared to April but fell year-on-year and sausages also followed the same trend. Offal exports totalled 11,600 tonnes in May 2023 holding a 49% share of total export volume.