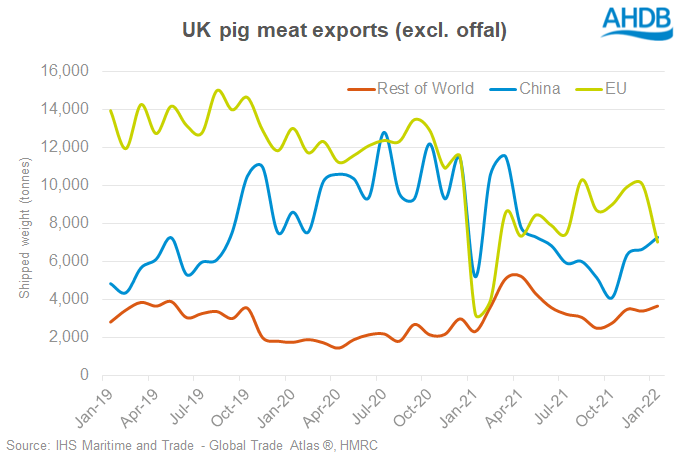

The UK pork trade continues to struggle on the main stage as issues including waning Chinese demand and oversupply within the EU persist into 2022, according to AHDB.

UK pig meat exports were down by 11% in January on the previous month as the country struggles to make its mark outside a year on from its formal exit from the EU.

This has not been helped by a marked recovery in the Chinese pig herd and oversupply of pork in the EU, which continued to impact export volumes for the second half of 2021.

Duncan Wyatt, AHDB lead analyst for red meat noted that although volumes to China have been increasing in recent months, this is from a low base compared to 2020 and in January 2022 only 7,300 tonnes was exported there, down from around 11,000 in the same month the previous year. There remain three processing facilities in the UK that do not have access to the Chinese market following self-suspension in the wake of Coronavirus outbreaks.

In January the UK exported 8,100 tonnes of pig offal, 20% more than a year ago but 23% less than in December.

“Weakness in the EU market has meant a plentiful supply of competitively priced product,” commented Mr Wyatt. “Combined with the continued re-opening of the foodservice market here, this meant that import demand in January picked up.”

83,000 tonnes of pig meat products were imported ny the UK in January, nearly twice that imported a year ago and 22% more than the amount imported in December.

Imports of bacon to the UK rose to 27,000 tonnes in January compared with 9,500 tonnes a year ago and 17,500 tonnes in December.

“It is not clear that this rapid increase in imports will be sustained,” said Mr Wyatt. “Prices for pigs on the continent have risen sharply in the past few weeks, as a shortage of slaughter ready pigs has appeared. It may also be that more “finished” products were temporarily imported (such as bacon), as the ability to process imported loins for example, could have been curtailed by a shortage of processing capacity here.”

He added that weekly contributions paid by processors in the UK are reported to have increased, which will feed into contract prices and then into the SPP, hopefully reducing the price competitiveness of European pigs.