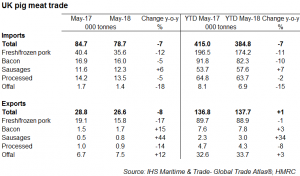

HMRC reported UK imports of fresh/frozen pork declined 12% year-on-year during May, to 35,600 tonnes. Meanwhile, reported exports dropped by 17% on the year, to 15,800 tonnes.

A decline in exports was recorded to all the major destinations, with shipments to China being recorded at 18% (-600 tonnes) below year earlier levels. On top of this, shipments to Hong Kong declined by a similar volume, to less than half the amount of a year ago. This reflects the lower import demand on the Chinese market so far this year.

Exports to other EU countries also declined 18% (-2,200 tonnes) compared to May 2017, to 9,800 tonnes. Shipments to Denmark particularly took a hit, with volumes halving on the year at 1,400 tonnes. Trade with Italy was exceptionally strong in May 2017, and this year the reported figure for May was more in-line with the long term trend at 100 tonnes, which is 20% of the year earlier volume.

Nonetheless, pockets of export growth remained in May. Shipments to the US increased by 34% (+300 tonnes) on the year, to 1,200 tonnes. Exports to Poland also returned to almost 400 tonnes during the month, having been negligible last year.

The reported total value of UK pork exports during May stood at £22.5 million, 15% below year earlier levels. The US was the only major market to record an increase in value, growing by 24% year-on-year, to £3.7m.

In contrast to fresh/frozen pork, HMRC reported export volume of offal increased strongly during May, up by 12% on year earlier levels, to 7,500 tonnes. Shipments to China, the largest destination for UK offal exports, increased by 20%, to 3,400 tonnes. This may reflect reduced competition from the US, with China imposing an additional 25% tariff on US pig meat products from April. However, a sharp decline in average export prices meant the value of UK offal exports still slipped by 1% on the year, to £6.5m.

Looking at imports, according to HMRC, UK fresh/frozen pork imports declined 12% during May to 35,600 tonnes. There were declines in shipments from all the major destinations; in particular imports from both Germany and the Netherlands declined by 22%, to 6,200 and 3,900 tonnes respectively. Shipments from Denmark, which supplies around a third of UK imports, decreased by 3%, to 11,800 tonnes. There have been doubts surrounding the accuracy of this data for a number of months, however recently the trends seem to have become more reliable.