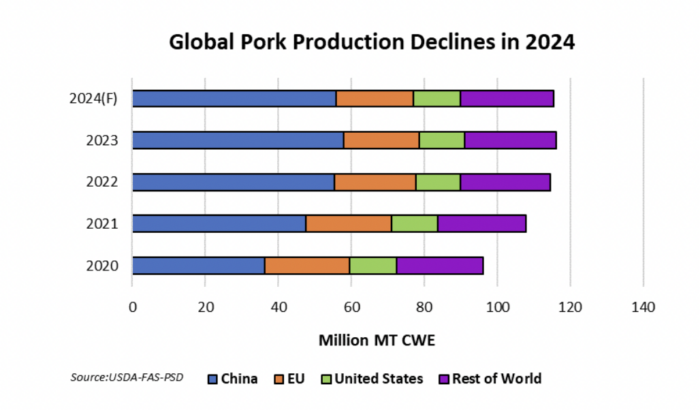

Global pork production in 2024 is forecast to fall by 1% to 115.6 million tonnes in 2024, as lower production in China more than offsets production gains in the EU, US and Brazil.

USDA’s latest quarterly global meat market analysis forecasts that Chinese pork production will be 3% lower this year at 56m t, after persistently low prices in 2023 triggered industry consolidation.

In contrast, partial recovery is predicted for EU pork production, which is forecast to increase by 2% this year to 21.2 million tons, driven by high piglet and finished pig prices, which incentivised producers to begin rebuilding the sow herd at the end of 2023. This will lead to a 2% higher pig crop in 2024, according USDA’s analysts. Furthermore, cheaper feed prices are expected to improve sector profitability and increase pig weights in the EU.

Pork production in Brazil is forecast to grow by 4% to 4.6m t, as producers continue to benefit from lower production costs. Brazilian production is also expected to be supported by improving domestic demand and robust export demand as it remains the lowest-cost supplier.

US pork production is forecast to grow by 3% this year to 12.7m t, on the back of larger than previously expected pig supplies.

Exports

Exports

Global pork exports are expected to grow by 4% this year to 10.5m t in 2024, with increased shipments expected for all major exporters, including the US, EU, Brazil, and Canada.

EU exports are forecast to rise by 3%, as higher production and increased price competitiveness in the second half of the year provides opportunities for growth. In particular, EU exports are anticipated to make significant gains to the US.

Brazilian pork shipments are forecast to rise by 5%, with ‘particularly strong competitiveness’ to the Philippines, Chile, and Hong Kong.

Canadian exports are forecast to edge up by 1%, with modest export gains expected in Japan and South Korea, where it will compete with the US for market share.

US pork exports are predicted to rise by almost 8% in 2024, with ‘meaningful gains to core markets’, especially Mexico and Japan, as abundant supplies and strong export competitiveness position the US for export growth.

US pork exporters will also look to build on strong 2023 market share gains in South Korea and Australia, USDA predicts.