UK pig producers are yet to feel the benefits of the current ‘China effect’ on global pig prices partly as a result of Brexit stockpiling, according to AHDB analysis.

The Standard Pig Price (SPP) finally showed a welcome increase last week, rising 0.64p to average 138.31p/kg. But this some disappointing weeks of decline at a time when virtually every other market in the world is rising as China buys up more pork to fill the growing gap in its market.

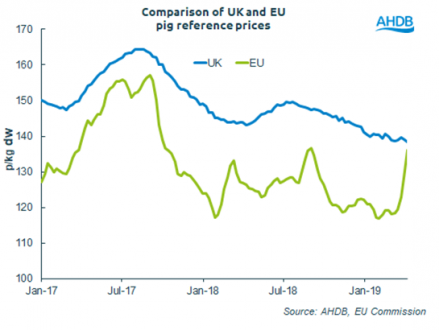

The EU reference price increased by nearly 20p/kg between the start of February and April 8, when it reached 136.12p/kg, just 2p below the UK reference price. This means that when delivered to UK customers, standard UK pork will now be cheaper than the EU equivalent, AHDB analyst Bethan said.

“This situation reflects some unusual features in the UK market right now,” she said. “Reports indicate large volumes of pork were stockpiled in preparation for a potential no-deal Brexit on March 29. The industry will need to work through these stocks until demand can rise.

“In addition, earlier factory breakdowns resulted in a high kill rate over the past two weeks. This temporary boost to supply has probably also depressed the market somewhat. If more pigs go out of spec due to delays in marketing, this can also lower the average pig price.

“In contrast, reports indicate that EU pig supplies have tightened lately, reflecting the decline in the breeding herd last year. This would help support prices at a time when demand is rising.”

Ms Wilkins predicts that the UK market will soon start to follow the UK market – although the timing is uncertain.

The EU supplies around 60% of pig meat consumption in the UK. British produce typically attracts a premium due to higher demand in certain sectors. The UK should also be able to capitalise on the increasing demand from China, she added, pointing out that EU pork and offal shipments to China have increased by over 40% in the first two months of this year.

“Therefore, with EU prices moving ahead of British prices, if they stay there, it is inevitable that the UK pig price will ultimately also have to rise. Although, with disruption to throughput over the Easter period, we can’t be sure exactly when this will happen,” Ms Wilkins said.