While 2023 saw some stability return to the pig sector, where do we go from here remains clouded in uncertainty? ALISTAIR DRIVER explores the state of the pig herd, the market prospects and more as the pig sector looks continue on the road to recovery in 2024

2023 has been a year of partial recovery and relative stability for the British pig industry, following two years of turmoil, angst and crippling financial losses.

The industry is unquestionably in a better place than it was 12 months ago, with some losses recouped and investment, tentatively at least, taking place again.

But where we go from here in 2024 is not easy to gauge against the backdrop of an uncertain marketplace, with, as always, EU and global factors to the fore, and a pig production base that is still, in part, lacking the confidence and finance to truly rebuild for the future.

The structure of the industry is changing, with the integrated sector, led very much by Cranswick, steadily increasing its market share versus the independents, while the industry’s infrastructure inevitably contracted during 2023, including the loss of a major abattoir, Pilgrim’s Ashton plant.

Add to this, ongoing input cost concerns, continued labour constraints, a looming General Election, various policy questions and increasing challenges and opportunities from the sustainability agenda, not to mention the ever-present shadow of African swine fever (ASF).

In summary, there is much to look forward to in 2024, but plenty of potential pitfalls, too.

Pig herd recovery?

Just before Christmas, Defra released its UK June census figures, which gave a sobering indication of where the industry was, and still is, on the long road to recovery.

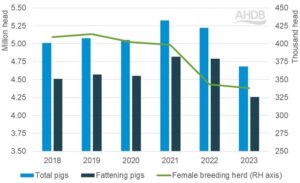

The total UK pig herd contracted by 10.3% to 4.7 million in June 2023, representing a loss of more than half-a-million pigs in 12 months, and the smallest figure recorded since 2012.

The total UK pig herd contracted by 10.3% to 4.7 million in June 2023, representing a loss of more than half-a-million pigs in 12 months, and the smallest figure recorded since 2012.

This was entirely driven by an 11% fall in the number of fattening pigs to 4.3m, the lowest number since 2015. This, in turn, reflected the ongoing impact of the 14% contraction of the female breeding herd between June 2021 and June 2022, a traumatic period that saw the loss of 55,000 sows, allied with the negative impacts the summer 2022 heatwave on fertility.

The census figures tally with historically low Defra monthly UK slaughter throughputs, which were 9.1% down so far in the year to November, although November’s clean kill, down 4.8% year on year, compared with 8% in October and 10% in September, suggested the gap might be closing.

Industry analyst Mick Sloyan pointed out that the Defra slaughter figures showed that Northern Ireland has become a more significant player this year, accounting for 18% of total UK slaughter compared with 16% five years ago.

As for the UK breeding herd, the best that can be said is that it has stabilised. The overall breeding was down by just 0.2% on June 2022 to 428,000 head, but there were varied trends within it that might contain pointers to the future.

As for the UK breeding herd, the best that can be said is that it has stabilised. The overall breeding was down by just 0.2% on June 2022 to 428,000 head, but there were varied trends within it that might contain pointers to the future.

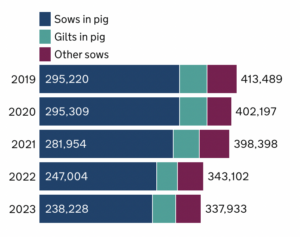

The overall female breeding herd lost another 5,000 sows to stand at just 338,000, a 1.5% decline on top of 2022’s 14% drop and the lowest the female breeding herd recorded in the past 21 years.

But while the number of sows in pig was down 3.6% year-on-year, the number of gilts in pig was up by a notable 13% and the number of gilts intended for first time breeding increased by 6.5%. Boars being used for service recorded a loss of 5.4% year-on-year.

Anecdotally, there may have been some modest breeding herd expansion in the second half of the year – the December survey results will not be available until well into 2024, however.

Despite, the overall breeding herd drop, the increase in gilt numbers shows signs of ‘improved industry sentiment’ and ‘tentative’ breeding herd recovery, reflecting the better financial state of the sector, according to AHDB red meat analyst Tom Dracup said.

But AHDB believes this indicates only ‘cautious growth’ for some producers, with little prospect of the industry ‘bouncing back to the heights of 2021 in terms of pig numbers, throughputs or production’.

Mr Dracup is anticipating ‘a small recovery in clean pig numbers in 2024, with a minor increase in the clean kill’.

In its annual Global Animal Protein Outlook, Rabobank forecasts ‘cautious’ UK pork production growth of 2%, on the back of ‘higher production intentions’ in the second half of 2023.

If feed purchases are an indicator of production intentions, AHDB’s recent pig feed production data, showing a 6.3% decline between July and October, does not point to imminent pig herd recovery.

Market prospects

Pig farmers, on average, returned to profit in 2023, particularly in the second and third quarters, as margins averaged £22/pig and £25/pig respectively, following 10 successive quarters of negative margins and estimated total losses of more than £750m.

Margins have been squeezed a little in Q4, with the SPP dipping below 215p/kg in mid-December, after averaging 224p/kg in Q3. Q4 net margins should still be around £16/pig, according to industry analyst Mick Sloyan.

Mr Dracup said the improved margins have provided ‘some opportunity to re-stabilise business after an incredibly challenging period’.

“But longer-term confidence remains in the balance, as the UK and EU market re-adjusts to production shocks, large changes in trade movements due to global price disparities (reducing the EU’s ability to export), alongside consumption pressures both domestically and in the wider EU continuing to cause some challenge for market values.”

One of the big drivers of the declining UK pig price since the summer has been falling EU pig prices. The EU reference price fell from 215p/kg in July to below 185p/kg in December, with the gap between the UK and EU reference prices widening from single figures to around 30p, making imports very competitive.

Mr Dracup added: “All eyes rightly remain on the EU marketplace as we look into our respective crystal balls for 2024. Most analysts are anticipating production decreases in the EU block of between 6 and 7% by the end of 2023.

“While we anticipate the macro pressures on production to remain, we foresee this easing from the current levels as we move into 2024, with EU production estimates back in the region of a further 2% fall for the full year ahead.

“Trade flows are seemingly developing into a new normal, with predictions of the EU’s ability to export outside the block limited by price points on the global stage, suggestive of greater internal product movement. This will undoubtedly drive some pressure from imports into the UK marketplace.

“Given these movements, following typical post-Christmas consumption pressures, we may begin to see some strength creeping into the EU marketplace as we move into the spring of 2024, with demand re-establishing slightly ahead of the production declines in the EU.”

In terms of domestic supply, a representative of one of the pig marketing companies said producers had done a good job of pulling forward pig numbers in the run-up to Christmas, but predicted that pig numbers will be tight in early 2024.

“With disease issues, people going out and all the wet weather we’ve had, we are predicting that pigs could run very short in the spring of next year,” he said.

Finely balanced

Industry analyst Mick Sloyan described the market prospects for 2024 as ‘finely balanced, with global factors very much in play’, with a ‘few reasons for a modest celebration’, after the recent turmoil.

Industry analyst Mick Sloyan described the market prospects for 2024 as ‘finely balanced, with global factors very much in play’, with a ‘few reasons for a modest celebration’, after the recent turmoil.

He said the retail market has held up ‘remarkably well’ in the face of rising prices and the consumer squeeze, with Kantar data showing that in the year to the end of November, the total value of pork and processed products increased by 10% while volume sales fell by only 2.4%.

“The main concern for British producers is that the strongest performance has come in the sausage, bacon and sliced cooked meats part of the market, where British meat has a lower market share and is more susceptible to competition from imports,” he said.

Looking to 2024, he forecast that domestic supply is ‘unlikely to change significantly as producers will be very cautious about expansion’.

“The return to profitability this year, while undoubtedly welcome, has covered less than half the average losses made during 2022. This has left many businesses in a weak financial position and unable to finance expansion even if they wish to,” he wrote in the Weekly Tribune.

“Demand looks encouraging, but much will depend on how much pressure consumer spending is under. Continued pressure on consumer spending could help to sustain demand in 2024.”

He also predicted further pressure from EU imports, adding that the EU outlook ‘hinges on demand’. “EU production is not likely to change significantly for similar reasons to the UK, so it comes down to how well EU exporters can compete on global markets,” he said.

“This is likely to be very difficult, especially in the first half of next year. Pig prices in the US, the EU’s major competitor, continue to fall sharply. Currently, average carcase prices are less than half the level they were in July this year.

“Prices also continue to weaken in China. But, as the saying goes, ‘the cure for low prices is low prices’, so we may see production fall and the price position improve in the second half of the year.”

Cost outlook

Input costs remain historically high, but like the pig price, the picture has improved this year. Pig production costs averaged 195p/kg in Q3, compared with a peak of 240p/kg in Q2 2022, on the back of falling feed costs, which fell from 175p/kg to 121p/kg over the period.

Input costs remain historically high, but like the pig price, the picture has improved this year. Pig production costs averaged 195p/kg in Q3, compared with a peak of 240p/kg in Q2 2022, on the back of falling feed costs, which fell from 175p/kg to 121p/kg over the period.

Feed wheat prices, dropped back significantly over the year, quoted at around £185/tonne for January before Christmas, but soya remains expensive.

The outlook for 2024 is uncertain, and will, as always, be shaped by global weather patterns and geo-political events.

Addressing the NPA Pig Industry Group’s December meeting, the feed industry representative said. “Wheat is under £200/tonne but if you look to the futures, for November 2024, there’s a premium on top, which reflects the difficult situation out there with the weather at the moment. Barley’s trading down in the £160s, but, again, there’s about an £18 premium for November next year.

“Soya recently shot up to £500, but it has come back down to £450. This is related to weather, dollar movements and China.”

She pointed out that a lot of producers have finally come off higher priced contracts, in some cases around £300/t for wheat, which will significantly improve the overall cost outlook.

Writing in the company’s Outlook 2024, Anderson’s Harry Batt noted that, despite reduced feed prices, there is still ongoing pressure on cost of production, which remains 20-30p above the five-year average. Labour and electricity costs have continued to rise, compounded by increasing interest rates. The average cost of the working capital for a pig have increased from £1.52 to £4.55 per kilogramme in the last 18 months.

“This will be of great concern for a number of producers that have invested significantly over the last five years,” he said.

“I would question how producers can meet environmental and social targets while encouraging people to work in the industry if the profit margins aren’t there. Surely, the best opportunity to have environmental net carbon zero pork is by building a profitable industry for all.”

What is the mood among producers?

The PIG meetings are always a good gauge of the industry mood. During the regional round-up, producers were clear that there is ‘more positivity out there’ with pigs in profit, tempered by concern over falling prices.

The South-Central representative expressed concern about the pig price coming down at a time when cereal prices are potentially going to rise again and the soya price is high.

He also highlighted that producers are continuing to leave the sector, with another large producer in the region deciding to cull their herd.

The Midlands correspondent added: “There’s a bit more positivity out there. The price is coming down slowly, and it is more stable. Profitability is there at the minute, so hopefully it carries on into next year.”

In his New Year message to members, NPA chair Rob Mutimer said: “This year has felt rather like the hangover from the two previous years of carnage.

“We are at least seeing positive margins which is a blessing, but confidence among the majority of producers is still very low with many having to restructure their business and plug financial holes from the previous years.

“Thankfully, herd numbers are starting to stabilise, and confidence will hopefully start to improve throughout 2024.”

Hugh Crabtree, the NPA’s vice chair, said there was ‘a bit of movement’ on the investment front in the buildings and equipment sector. “My information is that the construction companies seem to have work going forward into next year,” he said.

But speaking to independent producers, it is clear that, while some are feeling more optimistic about the future, others remain scarred by recent events and are reluctant to commit too much on herd recovery or expansion for fear of history repeating itself.

This is against a backdrop of an ongoing shift in pig ownership from the independent sector to the corporate sector, with Cranswick, in particular, continuing to grow its pig herd in 2023, including the £32m acquisition of Elsham Linc, with 8,000 sows and a feed mill. Cranswick is now more than 50% self-sufficient in pigs, with the promise of further expansion to come, alongside major investment in its processing facilities.

There have been examples in 2023 of moves towards more sustainable processor-retailer pig contracts, with much greater awareness of on-farm costs, but it is not surprising that some independent producers remain uncertain about their future.

Against this backdrop, all eyes will be on progress with Defra’s review of contractual practice in the supply, ahead of a General Election in 2024.

Mr Sloyan said: “People react to pressure in different ways. In 2022, some abattoirs reacted by shorting historic supply agreements, creating a backlog of pigs on farm. That resulted in the government inquiry into fairness in the supply chain.

“Work is underway on new regulations to ensure fair contracts and transparent market information to enable fair competition to take place. There is an urgent need for those regulations to be introduced before competitive pressure in the market once again encourages corrosive behaviour in the supply chain.”

Rabobank’s global forecasts for 2024

Rabobank’s annual Global Animal Protein Outlook report forecasts that, globally, animal protein production growth will slow as margins remain tight in 2024, with producers and processors needing to adapt to sustain success.

Rabobank’s annual Global Animal Protein Outlook report forecasts that, globally, animal protein production growth will slow as margins remain tight in 2024, with producers and processors needing to adapt to sustain success.

Input costs and inflation are likely to fall, but will remain at a higher level than pre-pandemic, and, along with tighter supplies, will push animal protein prices up and constrain global consumption in 2024, it predicts.

Rabobank’s analysts forecast that, overall, pork production will ‘contract modestly’. The report is broken down into the different markets.

Europe: EU pork production is forecast to decline by 3% in 2024, a slowing of the contraction of the past two years. The return to positive margins on the back of record prices and easing feed costs has slowed the decline of the sow herd in the eight main EU pig producing countries.

In the UK, ‘cautious’ growth of 2% is forecast, on the back of ‘higher production intentions’ on pig farms in the second half of 2023.

China: Pork production is predicted to remain flat or drop slightly in 2024 in this key global market, following a herd contraction in 2023. More rationalisation is expected in Q4 2023 and Q1 2024 to rebalance supply and demand.

Chinese pork imports increased by 6% in the first nine months if 2023, slowing in the fourth quarter. Rabobank analysts predict further growth of 0 to 5% next year, as Chinese demand recovers, and inventory levels decline.

Pork production growth is also forecast in Vietnam.

Brazil: Brazilian pork production is forecast to increase by 3-4% in 2024, with Brazilian pork exports, which are set to reach a record this year, predicted to increase again, by 2-4%, due to slightly higher import volumes in China and elsewhere.

North America: North American pig breeding herds are expected to see ‘modest contraction’ next year, as pig prices continue to lag behind rising costs. Rabobank is forecasting a 0.6% decline in North American pork production, with larger falls in the US and Canada offset partly by a 1.6% increase in Mexico.

US exports are, nonetheless, expected to rise by a further 3% after a ‘strong’ 2023.